Back to all articles

Jul 12, 2025

How To: Make CA Tax Payments Online

These instructions outline how to make an individual tax payment online through the California Franchise Tax Board (FTB) website.

Overview

Table of Contents

If you are well prepared, the entire process should take no more than 5 minutes.

What You’ll Need

Payment information

- Reason for payment: balance due, estimated tax, amended return, etc

- Tax period: the year your payment will be applied to

- Tax form: the form or tax type your payment will be applied to

Personal details

- Tax ID # (SSN)

- Legal Name

- Address

Payment details

- Payment amount

- Payment date

- Bank routing and account numbers

- Bank account type (checking or savings)

Step 1: Enter Payment Details

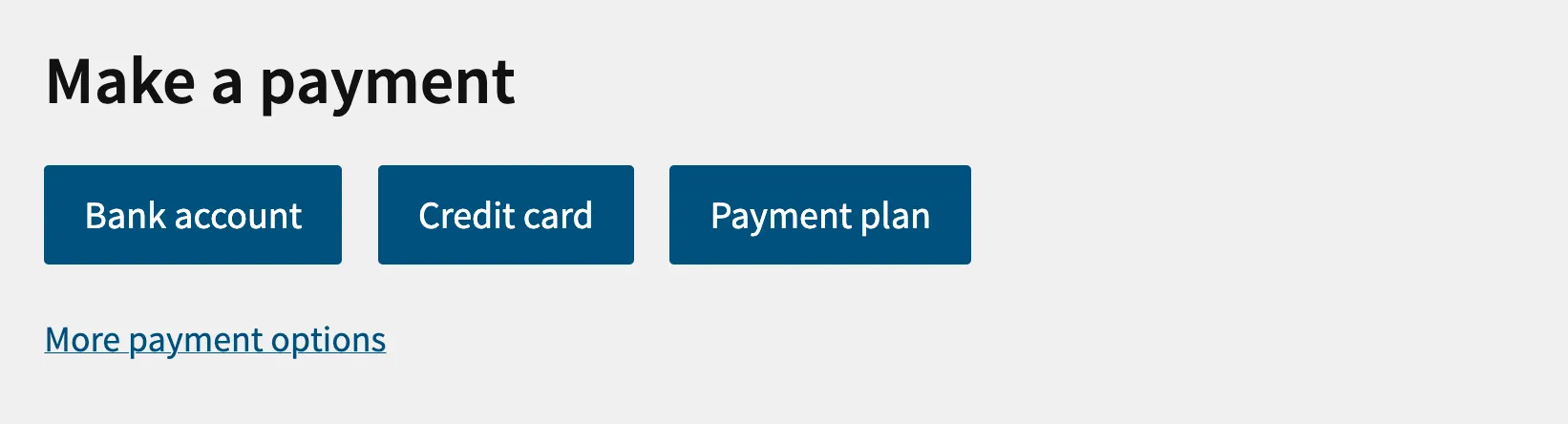

Navigate to ftb.ca.gov/pay and select the type of payment you would like to make

Select “Use Web Pay Personal”, and verify your identity by entering the following details:

- Social Security Number

- Last Name

Select “continue” and enter the following personal information:

- Legal Name

- Address

Select “continue” and select a payment type:

- Estimated Tax Payment. Select this quarterly payment type when you do not have tax withheld or not enough tax withheld from wages or income as you earn it (Form 540-ES). For more information, see estimated tax payments.

- Bill Payment. Select this payment type to:

- Pay a bill or notice.

- Make a payment on your existing balance due.

- Pay a dishonored payment penalty.

- Pay the mandatory e-Pay penalty.

- Tax Return Payment. Select this payment type when you:

- File a current or prior year tax return with a balance due (Form 540, 540A, 540 2EZ, or 540NR)

- e-file and have a Payment Voucher for Individual e-filed Returns (Form 3582)

- Amended Tax Return Payment. Select this payment type when you file a current or prior year amended tax return with a balance due.

- Extension Payment (Form 3519). Select this payment type when you:

- Owe a balance due on your tax return due by April 15th, and

- Plan to file your tax return by the extended due date of October 15th.

If the 15th falls on a non-banking day (weekend day or a banking holiday), your payment is due on the next business day following the non-banking day.

Note: This does not extend the time for payment of tax; the full amount of tax must be paid by the original due date.

- Notice of Proposed Assessment (NPA) or Form 3834 Payment. Select this payment type to:

- Pay a Notice of Proposed Assessment.

- Make a payment for a balance due calculated on Form 3834.

Note: These payments will be reflected on your account as a NPA Payment.

- Pending Audit Tax Deposit Payment (Form 3576). Select this payment type if you are making a payment on a pending tax assessment. You will be asked the source of the pending tax assessment:

- Payment details (amount & date, up to one year in advance)

- Bank account details (routing & account number, type of account)

Step 2: Review and Complete Payment

Review the summary of your payment information, and make any necessary changes.

It is essential that the following information is correct:

- Tax Year for Payment

- Payment Amount

- Bank Routing & Account Numbers

- Sign electronically by entering your full name and Tax ID (SSN or ITIN)

© 2025 Better Technologies, Inc. dba Gelt

.png)

.png)

.png)

.png)